More About Custom Private Equity Asset Managers

Wiki Article

Some Known Details About Custom Private Equity Asset Managers

(PE): investing in firms that are not openly traded. Approximately $11 (http://go.bubbl.us/ddd0a6/87fd?/New-Mind-Map). There might be a couple of things you don't understand regarding the market.

Companions at PE companies elevate funds and handle the cash to produce favorable returns for shareholders, generally with an financial investment perspective of in between 4 and seven years. Personal equity firms have a variety of investment preferences. Some are strict investors or passive investors wholly depending on monitoring to expand the business and produce returns.

Due to the fact that the very best gravitate towards the bigger bargains, the middle market is a substantially underserved market. There are a lot more sellers than there are extremely experienced and well-positioned finance professionals with considerable customer networks and sources to handle a deal. The returns of personal equity are typically seen after a couple of years.

The Of Custom Private Equity Asset Managers

Traveling below the radar of huge international firms, numerous of these little firms typically give higher-quality consumer service and/or niche items and solutions that are not being used by the large empires (https://www.openstreetmap.org/user/cpequityamtx). Such benefits bring in the passion of personal equity companies, as they possess the insights and smart to make use of such opportunities and take the firm to the following degree

Most managers at profile companies are provided equity and bonus offer compensation structures that compensate them for hitting their monetary targets. Exclusive equity opportunities are commonly out of reach for people who can not spend millions of dollars, however they should not be.

There are guidelines, such as restrictions on the accumulation amount of money discover this and on the number of non-accredited capitalists. The exclusive equity business draws in a few of the best and brightest in company America, including leading performers from Fortune 500 business and elite monitoring consulting firms. Law office can likewise be hiring grounds for personal equity works with, as bookkeeping and lawful abilities are essential to complete offers, and deals are extremely demanded. https://wh8yd8agf3f.typeform.com/to/bDcW2xON.

Custom Private Equity Asset Managers Things To Know Before You Get This

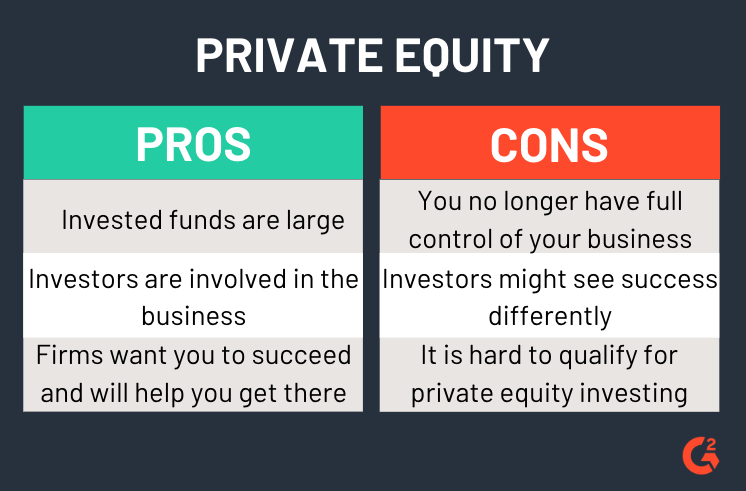

One more downside is the absence of liquidity; once in an exclusive equity deal, it is not easy to obtain out of or offer. There is an absence of adaptability. Exclusive equity additionally features high charges. With funds under administration currently in the trillions, personal equity companies have come to be appealing investment lorries for wealthy individuals and institutions.

For years, the qualities of private equity have made the possession course an attractive proposition for those who can take part. Since accessibility to private equity is opening as much as even more individual financiers, the untapped potential is ending up being a fact. So the question to take into consideration is: why should you invest? We'll start with the major arguments for buying personal equity: Exactly how and why exclusive equity returns have historically been more than other properties on a number of degrees, How including exclusive equity in a portfolio influences the risk-return account, by helping to diversify against market and cyclical risk, Then, we will detail some essential factors to consider and dangers for personal equity capitalists.

When it involves presenting a new possession into a profile, the many standard consideration is the risk-return account of that possession. Historically, private equity has actually exhibited returns similar to that of Emerging Market Equities and more than all other conventional asset courses. Its fairly low volatility paired with its high returns produces an engaging risk-return profile.

Some Known Questions About Custom Private Equity Asset Managers.

As a matter of fact, private equity fund quartiles have the best variety of returns throughout all alternate property courses - as you can see below. Technique: Internal rate of return (IRR) spreads out computed for funds within classic years separately and afterwards balanced out. Median IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The takeaway is that fund selection is crucial. At Moonfare, we carry out a stringent option and due persistance process for all funds detailed on the platform. The effect of including personal equity into a portfolio is - as constantly - reliant on the portfolio itself. A Pantheon study from 2015 suggested that consisting of private equity in a profile of pure public equity can unlock 3.

On the other hand, the most effective personal equity companies have accessibility to an also larger swimming pool of unidentified chances that do not encounter the same scrutiny, in addition to the resources to do due persistance on them and recognize which deserve spending in (Syndicated Private Equity Opportunities). Spending at the first stage means higher danger, however, for the business that do prosper, the fund advantages from higher returns

Examine This Report on Custom Private Equity Asset Managers

Both public and personal equity fund supervisors devote to spending a percent of the fund yet there continues to be a well-trodden concern with aligning interests for public equity fund management: the 'principal-agent problem'. When an investor (the 'principal') hires a public fund manager to take control of their resources (as an 'representative') they entrust control to the supervisor while retaining possession of the properties.

In the situation of private equity, the General Companion doesn't just gain a monitoring fee. They also earn a percentage of the fund's revenues in the type of "bring" (usually 20%). This guarantees that the passions of the manager are straightened with those of the investors. Personal equity funds also mitigate another kind of principal-agent trouble.

A public equity investor inevitably wants one point - for the management to enhance the supply price and/or pay out rewards. The investor has little to no control over the decision. We revealed above exactly how many exclusive equity strategies - specifically majority buyouts - take control of the operating of the company, ensuring that the long-term worth of the firm precedes, pushing up the return on investment over the life of the fund.

Report this wiki page